Internet commerce across Southeast Asia, also known as e-commerce, was worth $50 billion in 2017, according to a Google Temasek report.

But a more detailed report published by the iprice Group operating out of Kuala Lumpur show the bulk of transactions exceeded $10 billion in gross merchandize value (GMV) and conducted over mobile platforms as opposed to desktop purchases. (For further detail, go to iprice insight site here)

The GMV on firsthand goods of more than $10 billion represented compound annual growth rate of 41 percent, from only $5.5 billion in 2015, according to the Google Temasek report.

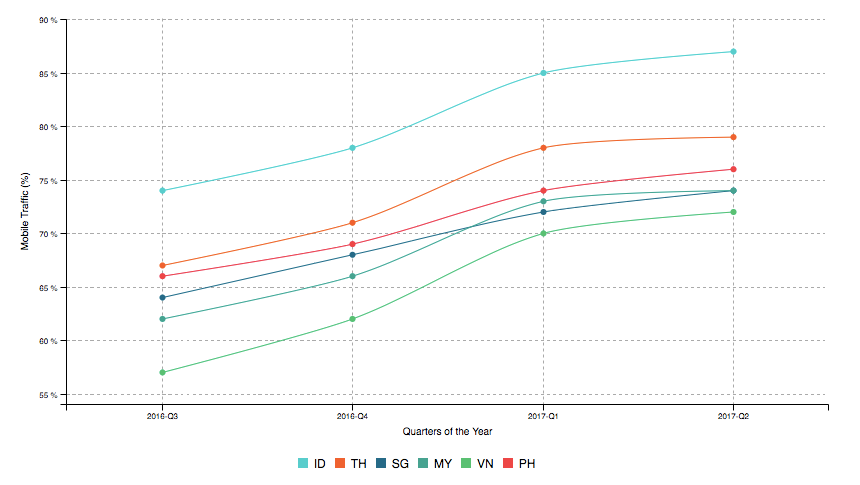

Angela Marie Gratela, content marketing executive at iprice, said mobile e-commerce transactions demonstrated unstoppable growth during the period by expanding an average 19 percent over 12 months and accounting for 72 percent of all e-commerce traffic in the Internet.

E-commerce transaction was largest in Indonesia, where it accounted for 87 percent, followed by Thailand, where it owns 79 percent of market. The Philippines was third largest, where e-commerce owns 76 percent, Gratela said.

In one of the countries surveyed was desktop-based purchases accounted for more than 30 percent of internet traffic, she quickly added.

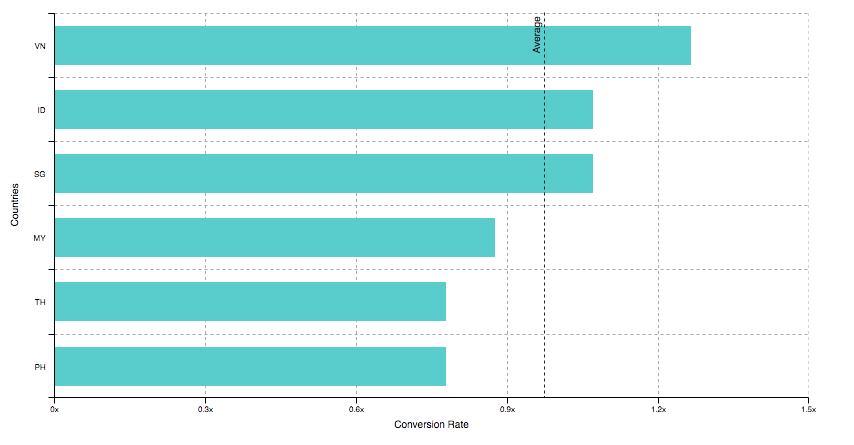

E-commerce conversion, indicating web site visits turning into actual purchases, was highest in Vietnam at 1.3 times and lowest in the Philippines where it stood at only 0.8 times. Vietnam’s conversion rate was higher than even Singapore’s 1.1 times. The numbers indicate the low level of correlation between the conversion rate and the level of maturity between each e-commerce market, Gratela said.

Data from iprice also show that while e-commerce transactions were fastest in the mobile segment, the conversion rate was substantially higher in the desktop segment.

According to iprice data, which used the average mobile conversion rate in Southeast Asia are reference, the conversion rate for desktop was 1.7 times higher than the average mobile conversion rate.

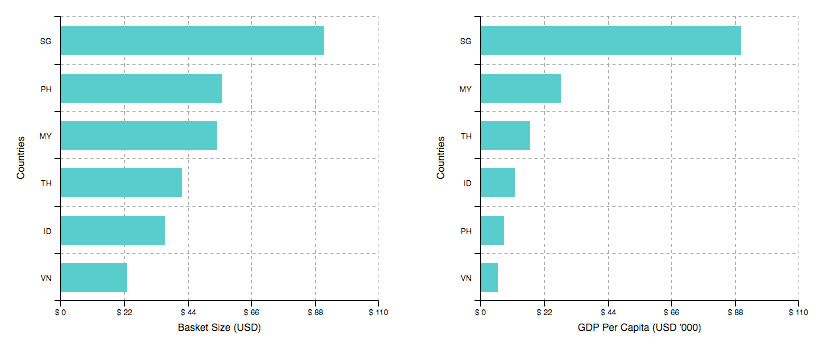

In terms of basket size, indicating the average amount spent for each online purchase by a customer was highest in Singapore, followed by the Philippines, with Vietnam at the bottom of the rankings.

“The basket size results to be closely correlated to the GDP per capita of each country. Singapore has the highest GDP per capita [$90,530], while Vietnam has the lowest GDP per capita [$6,880]. Relatively, Singapore’s merchants score highest with a basket size of $91, 3.7 times higher than their Vietnamese counterparts, with an average basket size of $23,” the iprice said.

Its data also show the average order value to be consistently higher on desktops than on mobile platforms ranging from 8-percent to 20-percent conversion rate in any country in Southeast Asia and an indication of consumer preference for completing larger purchases over desktops than on mobile.

Such purchases typically also happen between 9 a.m. and 5 p.m. across all six Southeast Asian countries in the survey, except in Singapore, where online purchases peak at 10 p.m.

“Considering the average number of order of the local country as reference [100 percent], the number of orders is highest between 9 a.m. and 5 p.m., when people are traditionally at work or school, with the exception of Singaporeans, who seem to enjoy evening shopping more than other countries, peaking at 10 p.m. Consistently across countries, there is a dip between 5 p.m. and 7 p.m., were people typically commute and have dinner, before getting back into online shopping until 11 p.m.,” the iprice reported.

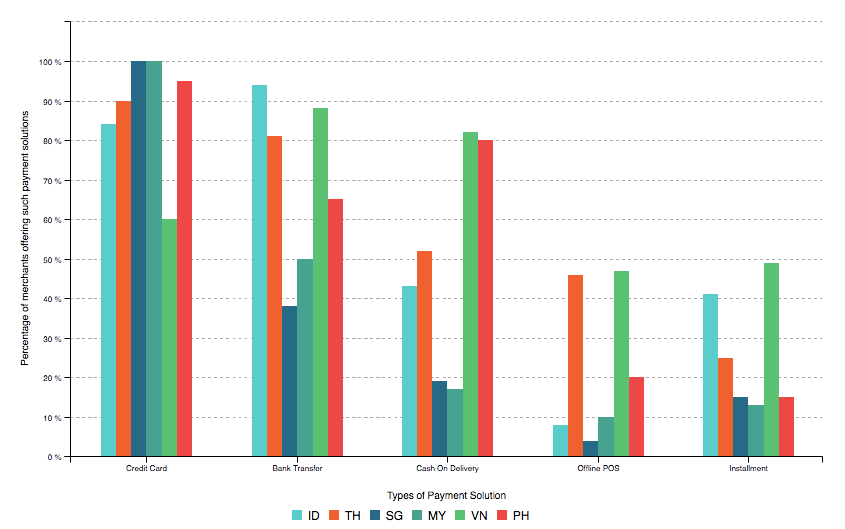

Peak days were Wednesdays and the preferred mode of payment was cash on delivery 80 percent of the time in both the Philippines and Vietnam. The iprice said this had “structural” reasons, chief among them the low credit-card penetration in Ho Chi Min City and Manila.

“Bank transfer is another very popular payment method across SEA, with respectively 94 percent, 86 percent and 79 percent of merchants in Indonesia, Vietnam and Thailand offering it. In Thailand and Vietnam, almost 50 percent of merchants offer off-line point of sales [ie., 7 Eleven].

Payment by installments proves to be very popular [and increasingly so] in both Vietnam [47 percent of merchants] and Indonesia [42 percent],” according to iprice.

Source : iprice.com | Business Mirror | Medium