Just three years ago, Vietnam was still a cipher in the global financial system. The Southeast Asian nation had only ten US$1 billion listed companies, while daily trading volume on the stock market came in at around US$100 million.

That picture, however, is vastly different today. It is not quite Wall Street, but the country’s financial centre, Ho Chi Minh, is fast heating up, reported South China Morning Post.

Last year, the country’s benchmark Vietnam Index soared to a 10-year high with a 47 per cent gain – taking the crown as Asia’s top performer, and the third best in the world.

The size of the Ho Chi Minh Stock Exchange surged 75.2 per cent over the year to hit US$115.46 billion, going by annual statistics from the World Federation of Exchanges (WFE). The number of listed companies valued at over US$1 billion as well as daily trading volume has tripled.

“Investors have been attracted by Vietnam’s combination of growth and stability,” said Barry Weisblatt, head of research at Viet Capital Securities, adding that a privatisation drive has also helped to spur market activity.

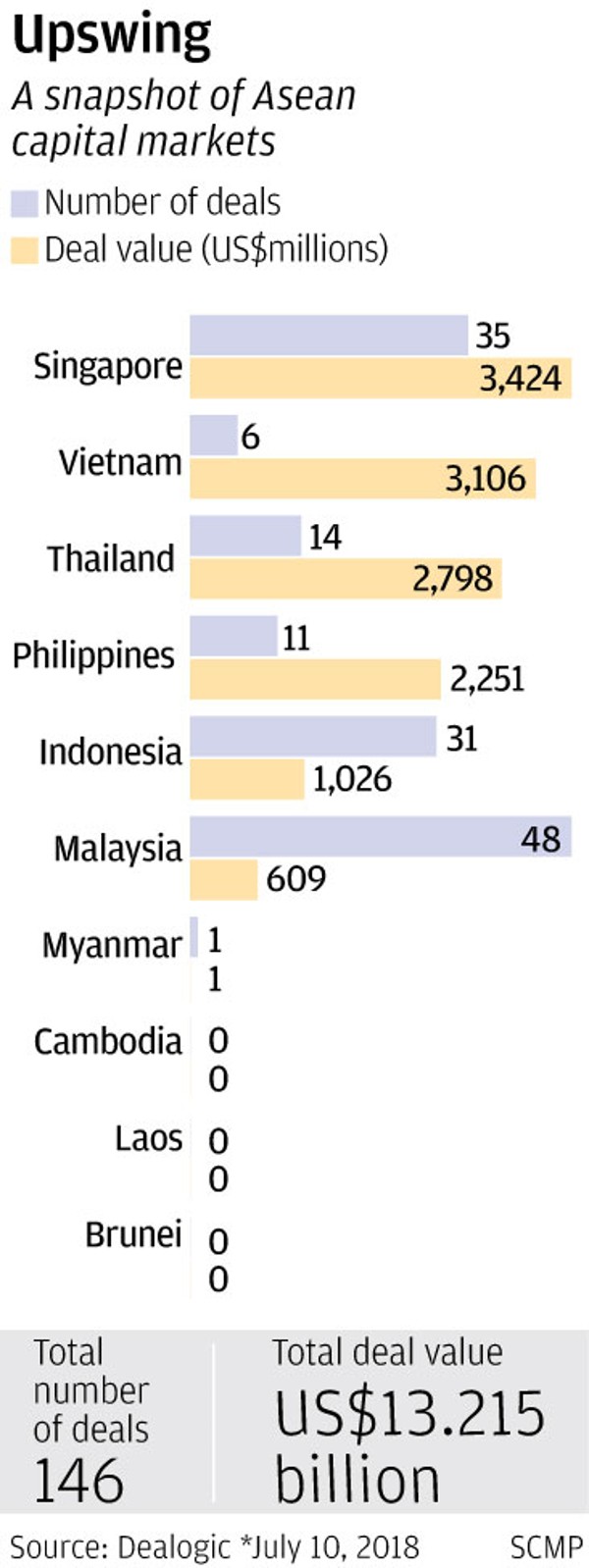

Vietnam’s phenomenal growth – Maybank Kim Eng Research regional economist Chua Hak Bin has dubbed the economy “a rock star”– is but a snapshot of the Association of Southeast Asian Nations’ (Asean) surging capital markets.

Growing in scale and sophistication, markets such as Indonesia and Thailand are challenging the status quo.

A new order

For the past two decades, Singapore has been the undisputed regional champion. Asean companies looking for a listing have viewed the Lion City as the first choice, especially given the republic’s exposure to international investors.

But things are quickly changing, with economies such as Indonesia, Thailand and the Philippines looking to dethrone Singapore from its lofty position.

With a market capitalisation of US$787.28 billion last year, Singapore was the 16th largest equity market in the Asia Pacific.

But its growth was insipid compared with others in the region. WFE data showed the Singapore Exchange’s (SGX) market capitalisation grew 13.6 per cent from 2016, compared with Hong Kong’s 37.3 per cent.

In Southeast Asia, the Ho Chi Minh Stock Exchange clocked the biggest jump at 75.2 per cent, followed by Indonesia (22.6 per cent), the Philippines (22 per cent), Thailand (15.7 per cent) and Malaysia (14.5 per cent).

The SGX in recent years has been plagued by a shrinking number of IPOs, delistings, and low liquidity levels.

For the first quarter of 2018, the daily average value of the bourse’s securities was S$1.45 billion (US$1 billion), compared with the average daily trading value of US$2 billion in Thailand, Asean’s most liquid market.

Regional bourses have been more successful in attracting new listings, particularly of domestic companies.

Vietnam had the biggest initial public offering (IPO) haul by proceeds in the first six months of this year, with three deals raising a combined US$2.5 billion, according to data compiled by EY. The communist country has more in tow; it has targeted IPOs for a total of 64 state companies this year, including telecoms firm MobiFone, and 18 others in 2019.

Indonesia booked the most deals at 19, with proceeds of US$700 million.

Meanwhile, the SGX attracted seven IPOs in the first half of 2018, with US$400 million raised in proceeds, thanks mainly to the listing of Chinese outlet mall operator Sasseur Reit.

Max Loh, EY’s managing partner for Asean and Singapore, notes it is natural for most listings outside Singapore to come from local names. “There is familiarity with the brand, business and market. Everything else remaining equal, there is a propensity for companies to list on their home exchanges – unlike before, when their capital markets were less developed and the SGX was the clear choice.”

In fact, Indonesia has already declared its intention to challenge Singapore. It has been trying to draw local companies listed in the Lion City to go public in Jakarta, as well as foreign firms operating in its country. The Indonesia Stock Exchange (IDX) also wants to increase its offerings, from local exchange-traded funds to derivatives, and replace the SGX as the top dog in Asean by 2020.

Fighting back

But Singapore is not giving up without a fight.

The city state’s stock market still dwarfs other regional exchanges and remains an international financial hub.

Robson Lee, a partner at law firm Gibson Dunn, notes that SGX also has an excellent reputation for its transparency, governance and enforcement of its securities laws and listing rules vis-à-vis the other Asean countries.

“But this would not be an insurmountable threshold for the other Asean stock markets to cross, and to give the SGX a run for its money in time to come. The SGX should not rest on its laurels,” said Lee.

That said, Singapore will, in the short-term, continue to play a key and relevant role even as the landscape shifts.

It is also moving to head off the competition by focusing on technology stocks, which many see as the future of the economy. The SGX recently announced moves to allow a dual-class share structure, used by big tech firms such as Facebook and Alphabet, formerly known as Google. “Singapore will continue to be the regional hub for some time, especially after allowing the new dual-class shares structure for some types of IPOs,” said Romaine Jackson, Dealogic’s head of Southeast Asia.

That could, in turn, attract entrepreneur-led Chinese names and Asean tech unicorns that have yet to list.

“It will be interesting where a name like Go-jek [a ride-sharing start-up comparable to Uber] in Indonesia decides to list in future,” Jackson said.

Long-term, market watchers believe the future could lie in collaboration rather than competition.

On the economic front, Asean is trying to move towards a common market with a free flow of goods, capital and people, so it would make sense for markets to be integrated as well.

Gibson Dunn’s Lee believes a more sustainable move would be to develop a pan-Asean stock market. This means installing a more unified capital market with comparable listing rules and regulations in each country that would allow international investors to trade across the region.

An Asean combined entity would offer investors more than 3,000 listings, firmly placing Asean on the global map.

Of course, such an idea may yet prove just a pipe dream. In 2013, the Asean Trading Link was set up to connect stock markets in Malaysia, Singapore and Thailand, but terminated without much fanfare last year amid lacklustre investor interest. But for average investors in Vietnam, that might not matter much. They may well be happy just raking in handsome gains from an economy with a long runway for growth.

Source: South China Morning Post