Over the last several years, China’s two technology giants Alibaba and Tencent have spent billions of dollars to secure major equity stakes in Southeast Asia’s leading tech startups.

Investments from the two Chinese giants have stimulated growth and expansion, but have also forced changes in leadership and strategy. In essence, Alibaba and Tencent are creating rival tech ecosystems that mirror their competition in China, and are requiring local startups to choose sides.

And for all its diversity—ethnic, cultural, religious and linguistic—Southeast Asia shares an important characteristic with China: a rising, tech-savvy middle-class.

Alibaba’s E-commerce

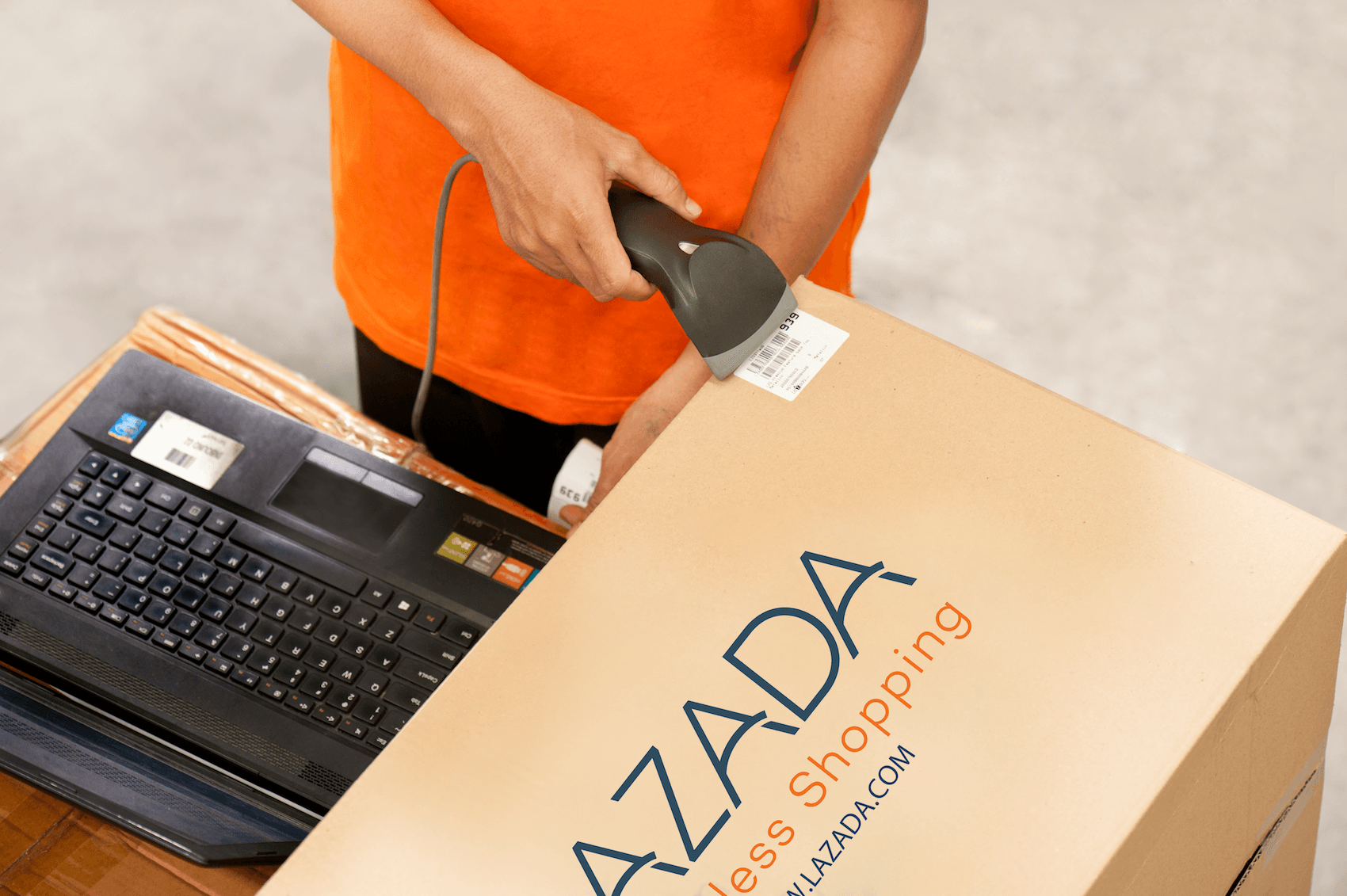

To date, Alibaba has invested more boldly than Tencent in Southeast Asia. Alibaba made the first major Chinese investment in the region’s tech sector in April 2016 when it paid $1 billion for a 51% stake in Lazada, Southeast Asia’s largest e-commerce platform.

Alibaba has also bet big on Tokopedia, Indonesia’s largest e-commerce firm. Tokopedia’s founders considered Lazada their main rival and were expected to join forces with Tencent.

But in August 2017, thanks partly to the aggressive intervention of Softbank’s Masayoshi Son, an early Alibaba backer, Alibaba pre-empted a Tokopedia deal with Tencent by swooping in and leading a $1.1 billion funding round.

Tencent’s Gaming Play

Tencent, for its part, owns a 40% stake in SEA, a Singapore-based gaming app that raised more than $1 billion in an October 2017 listing on the New York Stock Exchange. Like Tencent, SEA collects much of its revenue through games and web services.

Transportation: Grab vs Go-Jek

Tencent’s other major investment in the region is Go-Jek, an Indonesian startup that began as a motorbike-on-demand service and has expanded into ride-hailing for four-wheeled vehicles.

Alibaba is reportedly in talks to invest in Grab, the Singapore-based ride-hailing venture that is Go-Jek’s nemesis.

Grab, co-founded by Harvard Business School classmates Anthony Tan and Hooi Ling Tan, operates in eight Southeast Asian markets and dominates ride-hailing in the region with daily orders of over 6 million.

Grab scored another victory this March when San Francisco-based Uber announced plans to withdraw from Southeast Asia and sell its entire operations in the region to Grab for $1.6 billion and a 27.5 percent equity stake.

Immediately afterwards, Go-Jek announced plans to invest $500 million to expand into those three markets along with another where Grab operates, Vietnam.

In early June, according to Bloomberg, Go-Jek investors including Tencent and Warburg Pincus offered the company an addition $1 billion in funding to compete with Grab.

Source : Fortune