Razer has launched its long-awaited Razer Pay, and it’s chosen Malaysia as the first market for its digital wallet.

Razer is partnering with Malaysian corporation Berjaya to debut the service in the country.

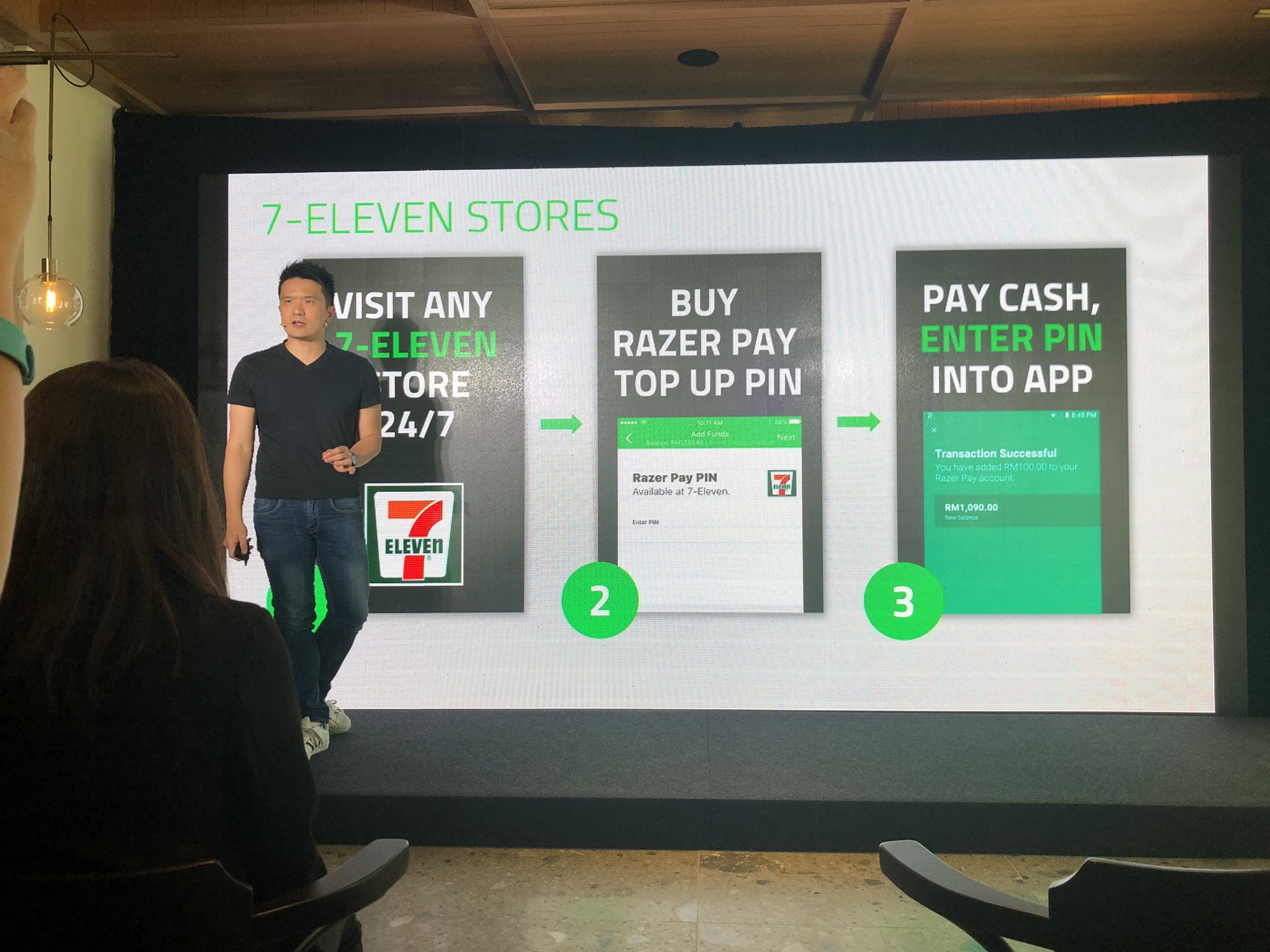

Users will be able to transfer funds to each other and top-up at 7-Eleven stores or via their bank account. Among the banks participating are AmBank, Bank Islam, CIMB, Hong Leong Bank, Maybank, Public Bank, and RHB Bank.

The wallet can be used for online transactions as well as for payment in offline stores. Supported chains include 7-Eleven, Starbucks, Singer, Cosway, Greyhound Cafe, Wendy’s, Kenny Rogers, and Krispy Kreme at launch, with more to be added later.

Razer Pay will also be available to users of One2Pay, the digital wallet launched by Malaysian payments startup MOL. Razer acquired MOL earlier this year. One2Pay users will see their app updated to Razer Pay automatically.

Razer intends to roll out Razer Pay in more countries in Southeast Asia, focusing on “interoperability” between them so that users can have “a seamless payment experience when they visit other cities.”

A New Challenger

Razer has been on a mission to launch its e-payment product since CEO Min-Liang Tan took up the challenge from Singapore’s prime minister last year.

The latest major update in the saga was the company’s partnership with Singtel to “create the largest e-payments network in Southeast Asia.” Singtel said it wanted to put together “a ‘star alliance’ of telco mobile wallets” in the region.

The deal would see the Singapore telco make its Dash payment system work together with Razer’s product, leveraging its reach across Southeast Asia through its partners and subsidiaries. Razer would also make available its ZGold digital currency to Singtel mobile users.

Razer Pay is launching in Malaysia in time to compete with GrabPay, which announced its entry into the country through a partnership with Maybank.

The market is only getting more crowded, with Ant Financial’s Alipay and WeChat Pay also available in Malaysia for Chinese travelers. Both services are preparing to launch local payment services as well.

According to Varun Mittal, ASEAN fintech lead for Ernst & Young, Malaysia is uniquely positioned for digital wallet services. The country’s urban areas are well-suited to consumers that are used to transacting through their bank or credit cards. But there also rural places where digital wallets could help unbanked users.

In a previous interview with Tech in Asia, Mittal stressed that for a digital wallet to get ahead of its competitors, it has to make sure that customers use it at least twice a day – or what he calls “the toothbrush test.” Digital wallet operators need to “master the art of high-frequency, low-value use cases” in order to win in the market, he said.

According to other experts like Anthony Chiam, head of financial services at market researchers JD Power, the challenge for players like Razer will be user acquisition, especially for customers who are not yet part of the company’s network. The tie-up with Singtel will presumably help with that as it seeks to expand Razer Pay across Southeast Asia.

Source: Tech In Asia