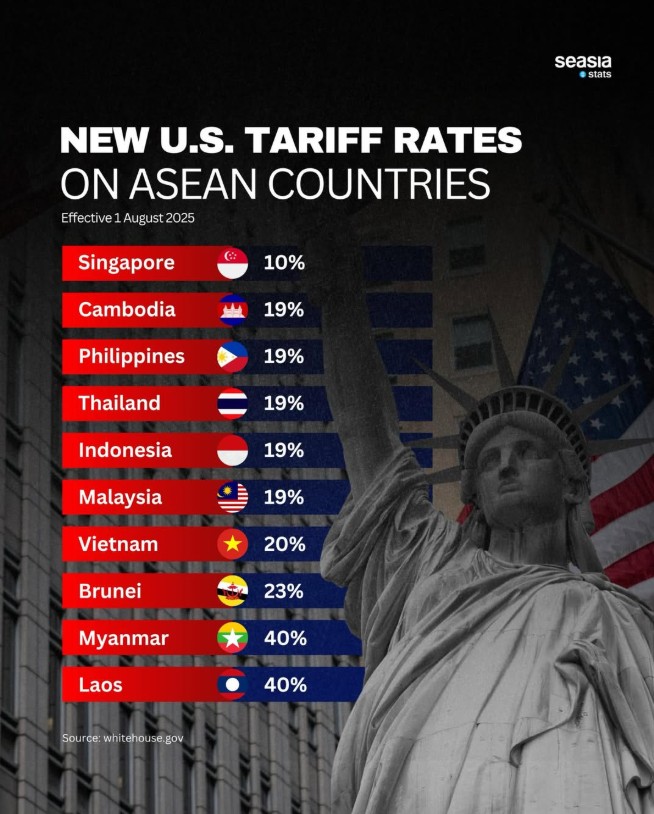

The implementation of the United States’ reciprocal tariff policy beginning on 1 August 2025 marks a significant shift in Southeast Asia’s trade landscape. The new tariff structure introduces clear distinctions in treatment among ASEAN member states and has an immediate impact on regional trade flows, particularly for countries and cities that rely heavily on the U.S. market as a primary export destination.

Differences in tariff levels directly affect export-oriented sectors such as agriculture, textiles, energy, electronics, and labor-intensive manufacturing. As a result, tariff policy has become a new variable that must be factored into both national and regional economic strategies.

Pressure on Cities and Industrial Hubs

The impact of the tariff policy is most acutely felt in Southeast Asia’s manufacturing and logistics centers. Cities such as Jakarta, Bangkok, and Manila, home to well-established production and export ecosystems are being compelled to adjust supply chains and market strategies in order to remain competitive amid rising trade costs.

Vietnam occupies a critical position within this dynamic. As one of the world’s major manufacturing hubs, industrial zones in Ho Chi Minh City and Hanoi are highly sensitive to tariff changes, particularly in the electronics and apparel sectors.

The 2025 tariff policy no longer functions solely as a measure to correct trade deficits. The United States has elevated the reciprocal tariff framework into a strategic instrument that assesses transparency, policy compliance, and regulatory credibility.

Under this approach, competitiveness is increasingly defined by the predictability of economic governance rather than by labor costs or production efficiency alone. Countries with clear and credible compliance pathways gain more predictable tariff treatment and access to phased liberalization opportunities.

Regional Policy Consolidation

This realignment was reinforced through a series of high-level engagements throughout 2025, including the 47th ASEAN Summit in Kuala Lumpur and President Donald Trump’s visits to Japan and South Korea. Together, these developments effectively reorganized Asia into distinct tariff layers that also reflect each country’s position within global supply chains.

The framework establishes a global baseline tariff, supplemented by country-specific adjustments linked to trade balances and market barriers. Economies that entered into cooperation agreements received greater tariff certainty and a defined pathway toward zero-tariff access through the Annex III mechanism, subject to strict verification. Rules of origin were also tightened to prevent export re-routing through third countries.

For ASEAN, the agreements reinforced the region’s role as a relatively stable and predictable manufacturing base. Commitments included cooperation on strategic raw materials, the removal of selected import duties, and customs reforms.

These measures strengthened compliance incentives and enhanced the region’s attractiveness to global investors. Tariff stability and clearly defined liberalization pathways have become key factors in maintaining ASEAN’s competitiveness amid growing regional rivalry.

Asia’s Trade Landscape Ahead of 2026

Beyond ASEAN, Japan and South Korea established a low-tariff corridor that supports high-value manufacturing, regional headquarters functions, and logistics integration. These arrangements were backed by large-scale investment commitments, replacing earlier tariff uncertainty with structured predictability.

At the same time, limited tariff adjustments involving China reflected a more cautious approach, combining partial relief with close monitoring and specific trade conditions under a temporary arrangement.

By the end of 2025, Asia’s trade system had consolidated into a clearly tiered structure. ASEAN occupies a mid-tariff pathway with scope for gradual liberalization; advanced East Asian economies operate within a low-tariff corridor; and several major economies remain within higher-tariff tiers.

Within this configuration, policy transparency, regulatory certainty, and verification compliance have emerged as the decisive factors shaping regional competitiveness and investment direction as Asia enters the 2026 trade cycle.