Indonesia has shown significant economic growth since the global financial crisis in 2008. Its GDP per capita has grown to $3603 in 2016 from $857 in 2000. Compared to other ASEAN countries, Indonesia owns the highest share out of the total ASEAN GDP. Additionally, domestic consumption has also increased by 0,1% from the period of 2014-2016. This is caused by the increasing amount of Indonesia’s citizens entering the consuming class with around 5 million total population annually, earning more than $3600/year. A high population and base consumption level from Indonesia’s citizens makes Indonesia one of the best countries to invest in South-East Asia.

A study conducted by Google & Temasek, e-Conomy SEA 2018 states that digital industry in Indonesia is growing rapidly. Having the most active internet user in South-East Asia totalling to 150 million users in 2018, Indonesia is considered to be the country with the biggest internet economy (27 Billion in 2018) and also the fastest (49% Compounded Annual Growth Rate in 2015-2018) in South-East Asia.

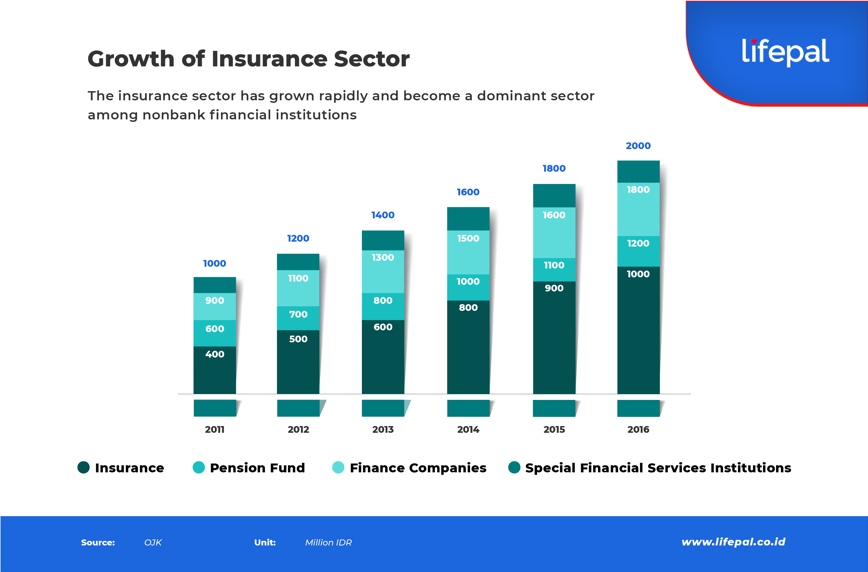

Economic improvement should be able to support the growth of insurance in Indonesia. But according to the data shown by OJK in 2017, insurance literacy in Indonesia was actually declined 2% from 2013. Furthermore, the insurance utility level was decreasing too with overall penetration < 2%. This means only 4.5 million Indonesian out of 254 million hold an insurance policy.

To overcome this problem, OJK has publicly announced that digital insurance marketing in Indonesia doesn’t require any form of regulation. “It’s feared that the birth of insurance marketing regulations through digital channel will curb the penetration of insurance businesses,''said the Deputy Commissioner for Supervision of Non-bank Financial Industry, Moch. Ihsanuddin. The government together with financial institutions have agreed to encourage public inclusion in the financial services sector with a target of 75% by the end of 2019.

To date, life insurance is the most dominant insurance segment in Indonesia. Life insurance segment has shown strong gains from last years reaching IDR 167 Trillion in 2016, the highest peak in history. While non-life insurance mostly driven by property and vehicle insurance.

The insurance positive growth in Indonesia will continue until 2020 with projected CAGR reaching 13% for Life Insurance and 10% for P&C Insurance. This is considered on the increasing consumption level and exploding middle class growth and also the education provided by both private and public sector has been successful in raising awareness on the importance of insurance.

Source : Lifepal.co.id