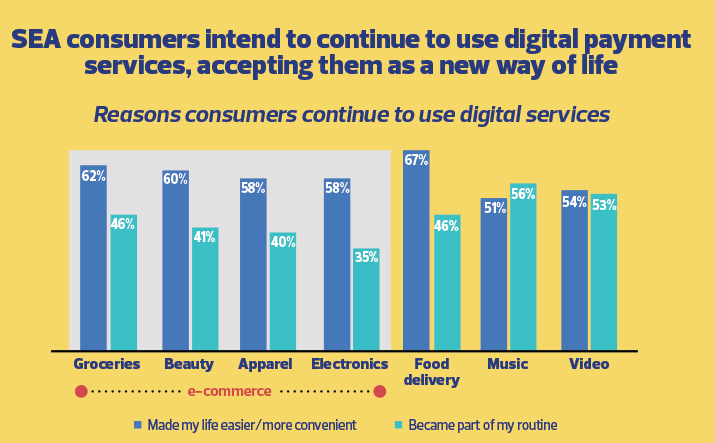

In Southeast Asia, digital consumption has been ingrained as a way of life. Many consumers in the region used e-commerce to get goods and services amid the Covid-19 lockdowns during the pandemic.

As the mobile-first region chose to use digital payment methods, this unwittingly contributed to the rising use of digital financial services. E-commerce and digital financial services have risen to prominence and are expected to continue to draw additional funding.

Because of the growing popularity of consumer financing choices and a growing need for supply chain financing, which will inadvertently bleed into e-wallets and digital payment systems, there is a lot of possibility for expansion in digital lending. By 2025, digital payments are predicted to account for 91% of all e-commerce spending, up from 8% in 2020.

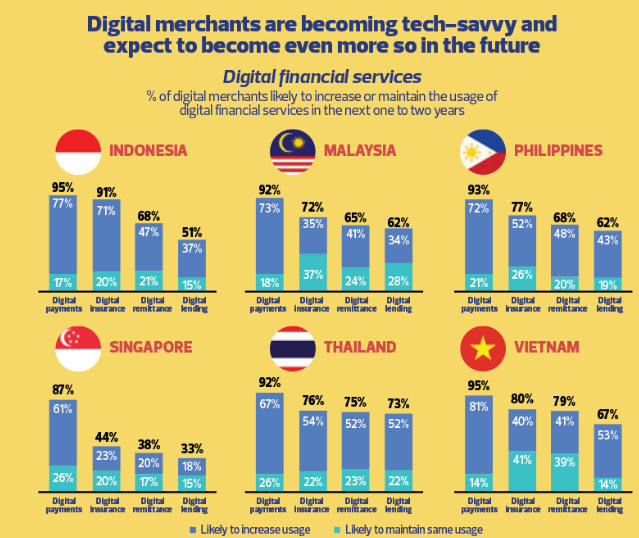

According to a Bain & Co analysis titled "e-Conomy SEA 2021, Roaring 20s: The SEA Digital Decade," eight out of ten merchants expect more than half of their sales to be made online in the next five years.

Food delivery and digital financial services are driving seismic transformations in consumer and merchant behavior in the region, which means the region's internet economy could surpass $1 trillion in gross merchandise volume by 2030.

- E-commerce is still driving the economy ahead.

E-commerce might account for more than two-thirds of GMV in 2030 as online buying becomes the norm for consumers of all ages in both urban and rural areas.

- The emergence of online grocery

If penetration hits 10% to 20%, e-grocery could expand to the scale of the entire e-commerce business (US$50 billion to US$100 billion GMV).

- Transportation and food, as well as online media, will be key to unlocking the next wave of growth.

If penetration and share of wallet continue to rise in underserved categories, such as beyond metro areas, these two sectors could reach the same level of contribution as e-commerce today.

Travel and transportation, food delivery, over-the-top streaming services, and financial management, such as investments and insurance, are all sectors where digital financial services will play a significant role.

As the market becomes increasingly saturated with payment options for consumers to select from, e-wallets and digital payment providers face an uphill battle. The most recent additions are "buy now, pay later" services, which are becoming more popular in the area.

As we progress towards a future dominated by e-wallets and digital payment solutions, the following comparison measures for selected nations in the region are provided.

Source: Theedgemarkets.com