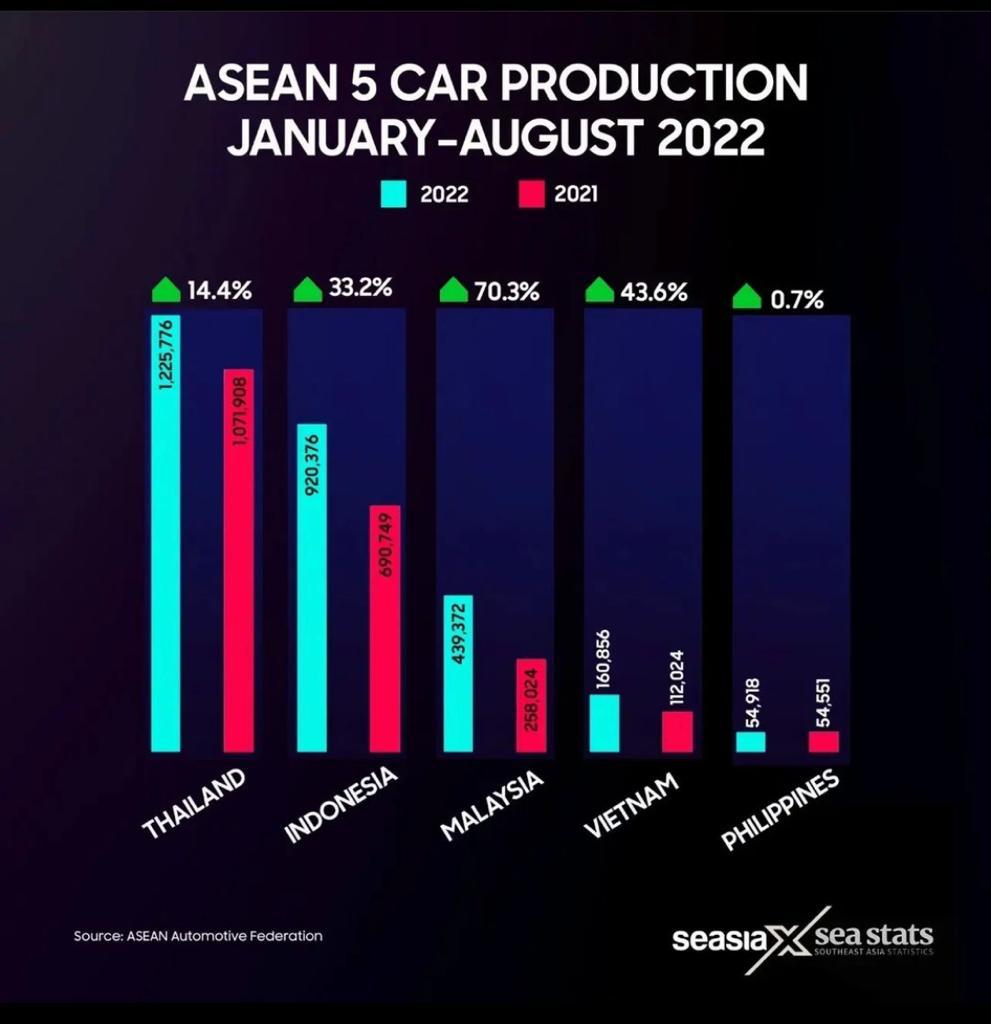

According to figures from the ASEAN Automotive Federation (AAF), the region's auto output increased 28.2 percent in the first eight months of this year.

According to AFF, the region's overall automotive output increased by 28.2 percent, or 2,804,386 units, from January through August of previous year to 2,804,386 units in the current period.

Thailand, the center of ASEAN's automobile industry, recorded a 14.4% increase over the first eight months of 2017 to 1,225,776 units. From January through August of this year, Indonesia's vehicle factories produced 920,376 units, a 33.2 percent increase over the 690,749 cars produced during the same time previous year.

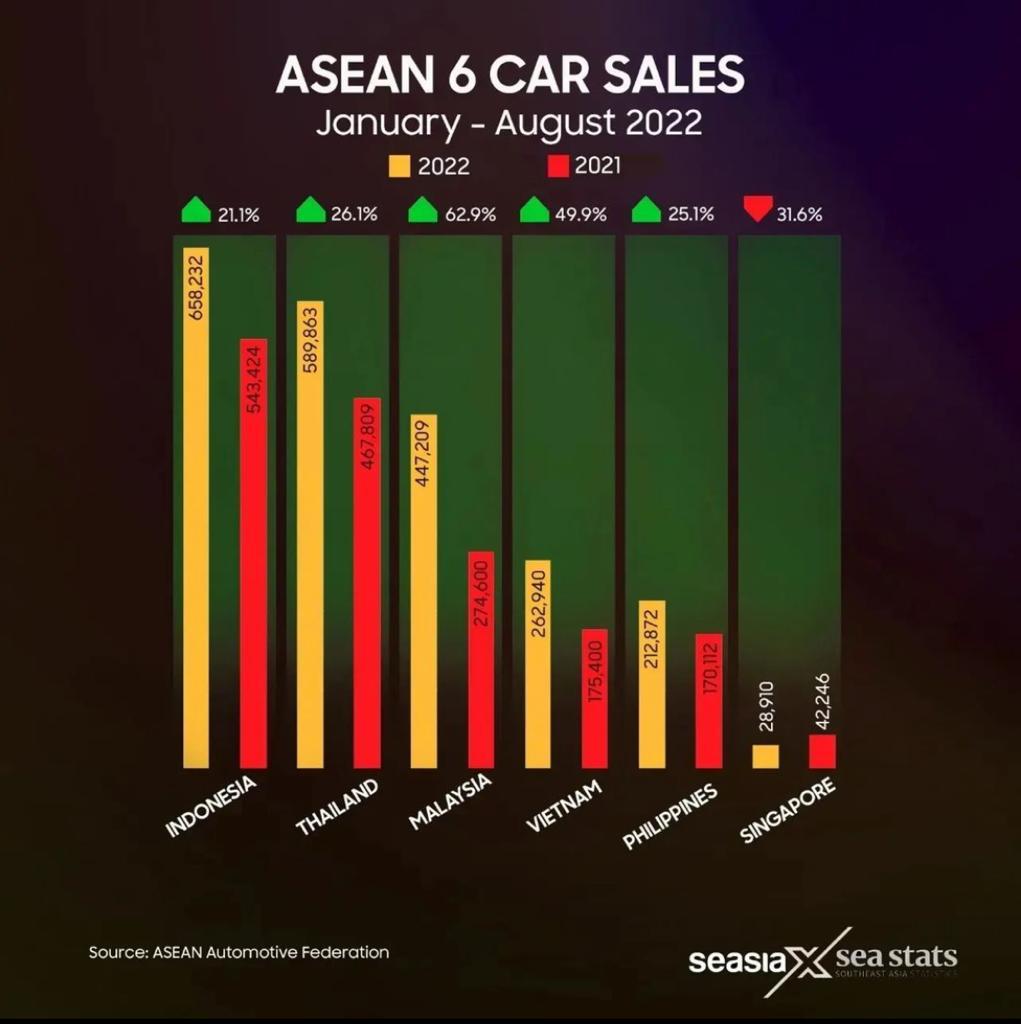

Vietnam's output increased by 43.6 percent to 160,856 units from just 112,024 units, while Malaysia's production increased by 70.3 percent to 439,372 units from 258,024 units. In Myanmar, production increased 192.7 percent from 1,055 units last year to 3,088 units this year. Malaysia saw a 62.9 percent increase in car sales from 274,600 to 447,209 units.

The AAF recorded total vehicle sales of 2,206,605 units between January and August, a 31.3 percent increase over 1,680,363 units during the same time last year.

The largest auto market in the area, Indonesia, was able to sell 658,232 vehicles, up 21.1 percent from the 543,424 vehicles sold the year before. Thailand saw a 26.1 percent increase in sales from 467,809 to 5898,863 units.

One of the major pillars supporting the expansion of the manufacturing sector and the national economy is the automotive industry. The neighboring Australia free trade deal, which was finalized in the spring of 2019, presents new potential for Indonesia's automotive sector.

A key step toward the recovery of Indonesian automotive products that meet international quality standards was made two years later when the Indonesian automobile sector was able to enter the Australian market. With the free trade agreement, automakers who have already established themselves in Indonesia can benefit from Australian import tax exemptions.

The ambitious target that Indonesia recently set was to increase the market share of electric vehicles in Indonesia to 25% of all vehicle sales by 2030.

The Indonesian government's goal, however, has been challenged by recent global events including the Russia-Ukraine war and the rise in COVID-19 cases in China, which clogged supply chains and sharply increased the cost of raw materials, driving up the price of electric vehicle batteries.

The Philippines increased its sales from 170,112 units sold during the same period last year to 212,872 units, a 25.1 percent increase.

With 262,940 units sold, or 49.9% more than the 175,400 units sold in the same period last year, sales in Vietnam have already overtaken those in the Philippines.

Sales in Myanmar also fell by 2.8 percent to 6,579 units from 6,772 units in the same time last year, while Singapore sales fell by 31.6 percent to 28,910 from 42,246 units last year.

Source: ASEAN Automotive Federation, Statista.com, ResearchAndMarkets.com