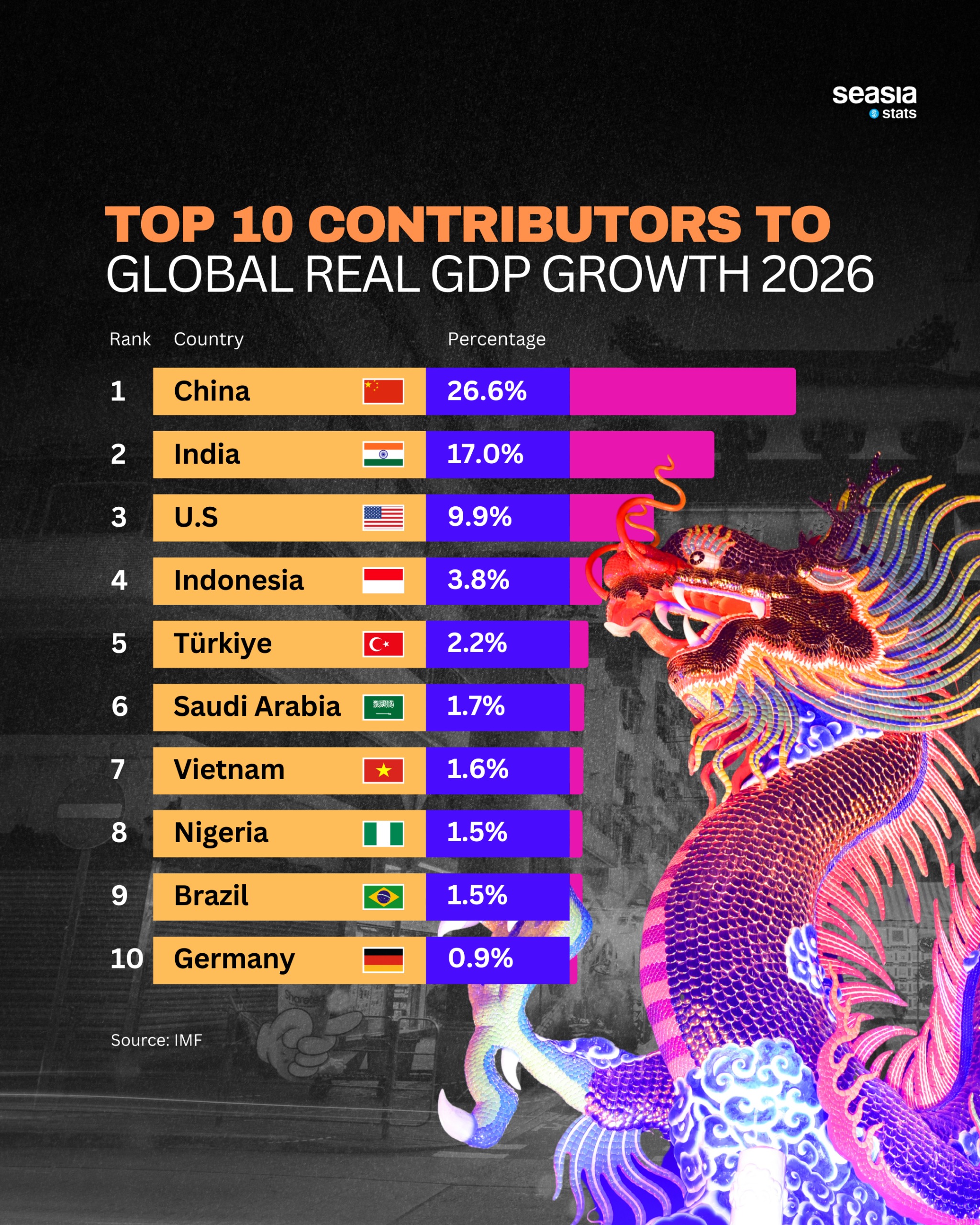

As the global economy navigates a fragile post-inflation recovery, a relatively small group of countries is expected to shoulder most of the world’s economic expansion. According to IMF projections visualized by Seasia Stats, the top 10 contributors to global real GDP growth in 2026 reveal a clear pattern: emerging economies—particularly in Asia—are doing the heavy lifting, while mature Western economies play a supporting role.

China and India: The Twin Engines of Global Expansion

At the top of the list is China, projected to account for 26.6% of total global real GDP growth in 2026. Despite slower headline growth compared to previous decades, China’s sheer economic scale means even moderate expansion translates into outsized global impact. Its manufacturing depth, infrastructure investment, and continued dominance in global supply chains keep it firmly in the driver’s seat.

Close behind is India, contributing an impressive 17.0% of global growth. India’s youthful population, rapid digitalization, and expanding middle class have made it the fastest-growing major economy. Together, China and India are expected to generate nearly 44% of all global growth, underscoring Asia’s central role in the world economy.

The United States and the Rise of Emerging Asia

The United States ranks third, contributing 9.9% of global growth. While still crucial, the U.S. share highlights a broader shift: growth momentum is increasingly concentrated outside advanced Western economies.

This transition is most visible in Southeast Asia. Indonesia ranks fourth globally, contributing 3.8%—a remarkable figure driven by domestic consumption, infrastructure spending, and resource-based industries. Indonesia’s scale makes it the single largest growth contributor in ASEAN.

Southeast Asia’s Growing Global Weight

Beyond Indonesia, Vietnam appears seventh on the list, contributing 1.6% of global growth. Vietnam’s rise reflects its transformation into a manufacturing and export powerhouse, particularly in electronics, textiles, and green manufacturing. Its integration into global supply chains continues to deepen as companies diversify production beyond China.

Although not in the top ten, other Southeast Asian economies are reinforcing the region’s momentum. Philippines is expected to remain one of Asia’s fastest-growing consumer markets, while Malaysia continues to punch above its weight in high-value manufacturing and trade connectivity. Collectively, Southeast Asia’s contribution to global growth is larger than that of most individual advanced economies.

The Middle Tier: Türkiye, Saudi Arabia, and the Global South

The middle of the ranking includes Türkiye (2.2%) and Saudi Arabia (1.7%). Both benefit from strategic geography, large domestic markets, and—particularly in Saudi Arabia’s case—massive investment linked to economic diversification under Vision 2030.

Rounding out the list are Nigeria and Brazil, each contributing 1.5%, highlighting the importance of populous emerging economies in Africa and Latin America.

A Shifting Global Growth Map

Finally, Germany closes the top ten at 0.9%, symbolizing the broader reality facing advanced economies: slower demographics-driven growth and limited upside compared to emerging markets.

Taken together, the 2026 outlook makes one trend unmistakable. Global growth is no longer led by the traditional economic core alone—it is increasingly powered by Asia, with Southeast Asia emerging as one of the most strategically important growth engines in the world.