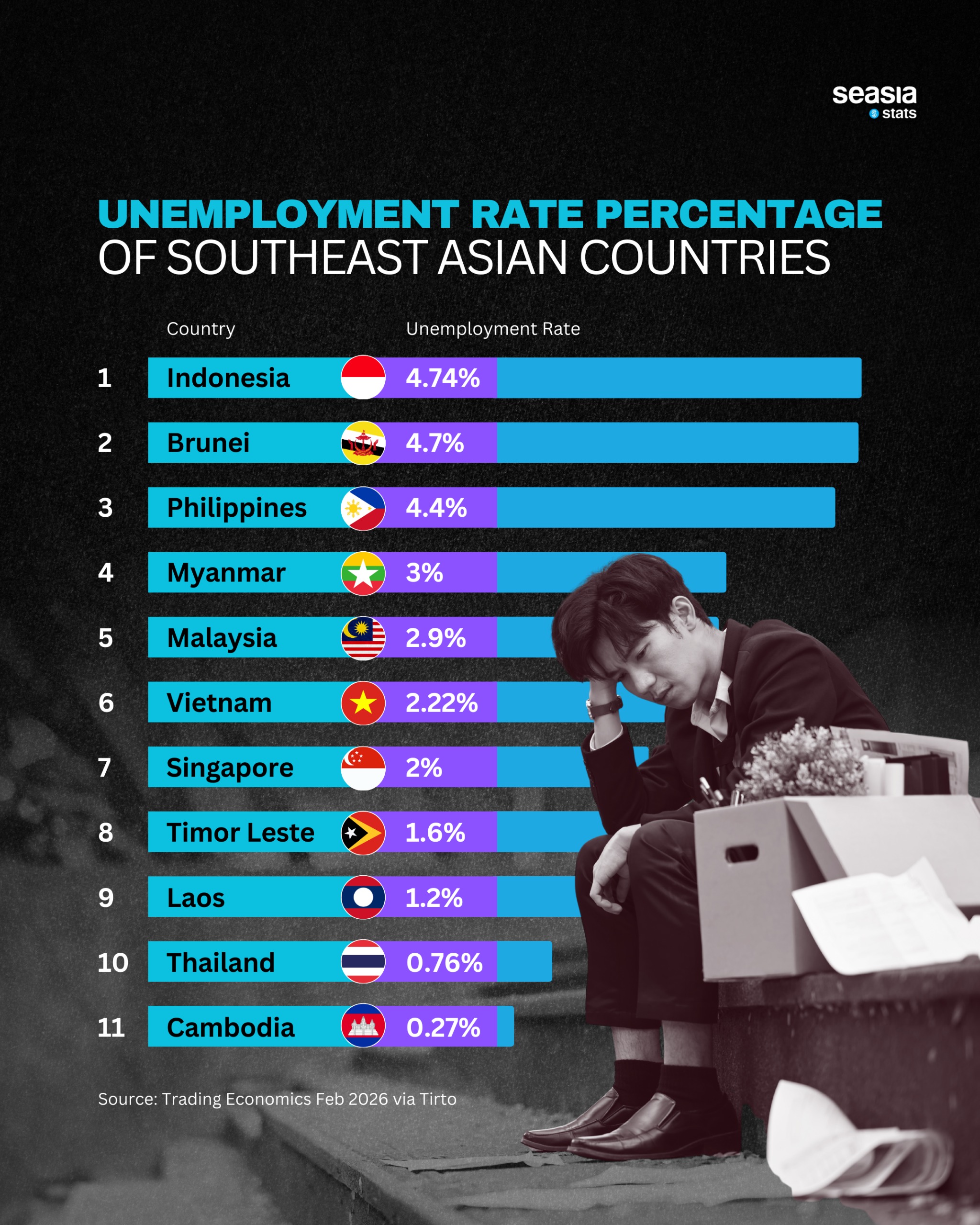

Southeast Asia’s labor landscape in early 2026 paints a picture of striking contrasts. While some countries continue to enjoy near-full employment, others are grappling with job market pressures caused by structural change, post-pandemic adjustments, and global economic uncertainty. According to data compiled from Trading Economics via Tirto, unemployment rates across the region vary widely—highlighting how diverse economic models and labor policies shape everyday realities for millions of workers.

The Highest Unemployment Rates: Pressure Points

At the top of the list is Indonesia, which recorded the highest unemployment rate in Southeast Asia at 4.74% as of February 2026. Despite being the region’s largest economy and population center, Indonesia’s labor market faces challenges from rapid urbanization, skills mismatches, and the ongoing transition from informal to formal employment.

Close behind is Brunei at 4.7%. Although Brunei’s absolute number of unemployed individuals is small, its oil-dependent economy and limited private-sector diversification continue to constrain job creation, especially for young graduates. The Philippines follows with a 4.4% unemployment rate, reflecting persistent issues such as underemployment, overseas labor dependence, and uneven regional development.

These three countries are the only ones in Southeast Asia with unemployment rates above 4%, marking them as key pressure points in the regional labor market.

The Middle Tier: Gradual Stabilization

A cluster of countries sits in the mid-range, showing relatively stable but still evolving labor conditions. Myanmarreports an unemployment rate of 3%, though this figure masks deeper challenges related to political instability and labor displacement. Malaysia, at 2.9%, benefits from a diversified economy spanning manufacturing, services, and technology, yet continues to face skills gaps in high-value sectors.

Vietnam posts a comparatively low 2.22% unemployment rate, supported by strong export manufacturing, foreign direct investment, and industrial relocation trends. Singapore, often seen as a regional benchmark, records 2% unemployment—reflecting a tight labor market balanced by active workforce reskilling and managed foreign labor policies.

Low Unemployment Doesn’t Always Mean Easy Jobs

At the lower end of the scale are Timor-Leste (1.6%) and Laos (1.2%). While these figures suggest strong employment, they also reflect large informal sectors where many people are technically “employed” but earn low and unstable incomes.

The lowest unemployment rates in the region belong to Thailand at 0.76% and Cambodia at just 0.27%. In both cases, extensive informal employment, family businesses, and agricultural work keep official unemployment extremely low—though concerns remain about job quality, productivity, and social protection.

What the Numbers Really Tell Us

Taken together, these figures show that unemployment alone does not fully capture labor market health in Southeast Asia. Countries with higher rates often have more formal job tracking, while those with very low rates may rely heavily on informal work. As ASEAN economies push toward digitalization, green industries, and higher-value services, the real challenge ahead will be not just creating jobs—but creating better ones.

Southeast Asia’s workforce is growing, young, and increasingly mobile. How each country manages this transition will define the region’s economic resilience in the years to come.