The World Federation of Exchanges ("The WFE"), the global industry group for exchanges and CCPs, published its 2017 Full Year Market Highlights report in last February.

On top of all points, amongst the key trends of 2017 when compared to 2016 were on the total domestic market capitalisation.

At the end of 2017 was 22.6% higher than as at end 2016, reaching a new record high of $87.1 trillion, an all-time high for the five-year period under review, globally and regionally.

This increase was driven by an uptick in domestic market capitalisation across all regions: the Americas up 17.8%, Asia-Pacific up 27.6%, and EMEA up 24.3% on 2016.

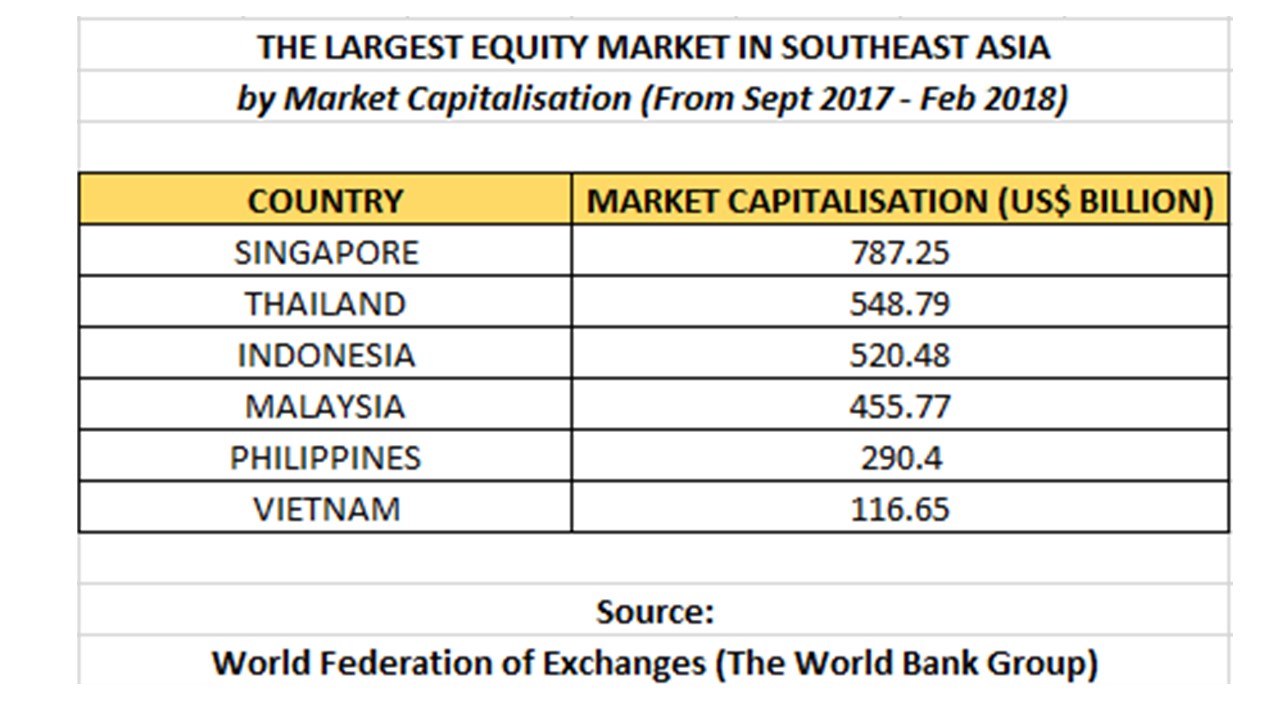

In Southeast Asia specifically, these are the "Equity - Domestic market capitalisation":

Note: The market capitalisation figures include;

(1) shares of listed domestic companies;

(2) shares of foreign companies which are exclusively listed in an exchange, i.e. the foreign company is not listed on any other exchange;

(3) common and preferred shares of domestic companies; and;

(4) shares without voting rights.

This increase in domestic market capitalisation was against a backdrop of a synchronised global recovery in GDP growth rates, the continuation of accommodative monetary policy in many regions, low levels of inflation, low market volatility, recovering commodity prices and strong corporate profits.